Mark Cuban on Diversity, Grubhub Layoff, and S&P 500's Massive Gains💰

Wend Catch-up🤳

Alright, tell me what’s new on the Wend App🗞

Pop Finance

1️⃣The Rock’s Tequila is doing Numbers 🥃🥃 …

Dwayne Johnson‘s Teremana Tequila has just announced a major milestone. The ultra-premium brand launched in early 2020 has now eclipsed the one-million-case-mark in annual sales--a total of some 9 million liters worth of liquid.

To frame that in proper context: out of hundreds of producers on shelves today, only 10 other tequila brands can claim to sell more. Among them is Casamigos, which famously sold to Diageo for nearly a billion dollars back in 2016. At the time, the Clooney co-founded company could only claim 120,000 cases per year in sales.

So, yeah, this is a pretty big deal for The Rock...Even by his own outsized standards. "The launch of Teremana Tequila has been an unprecedented and historic success in North America," the superstar actor said in a written statement. "It has far exceeded all of our expectations and is accelerating at an extraordinary pace towards its full potential. Taste, quality and affordability are the keys to Teremana's success. "To his point, the brand has already been recognized by no less than 17 of the top international spirits awards.

2️⃣Mark Cuban Doubles Down Diversity🤝…

Dallas Mavericks Owner Mark Cuban says that corporations who embrace the woke ideology are engaging in "good business." Cuban further emphasized the point by saying, "Call me woke." In an address given to business and political leaders at Michigan's Mackinac Island, Cuban characterized the politicization of corporate America as an embrace of diversity.

"Call me woke-you don't need to call it DEI, you can call it whatever you want -- I call it good business," Cuban said in a talk to political and business leaders on Michigan's Mackinac Island. "It means taking the people that you're selling to and making sure your workforce looks like them, and making sure you can reflect their values and being able to connect to that. That's what works for me."

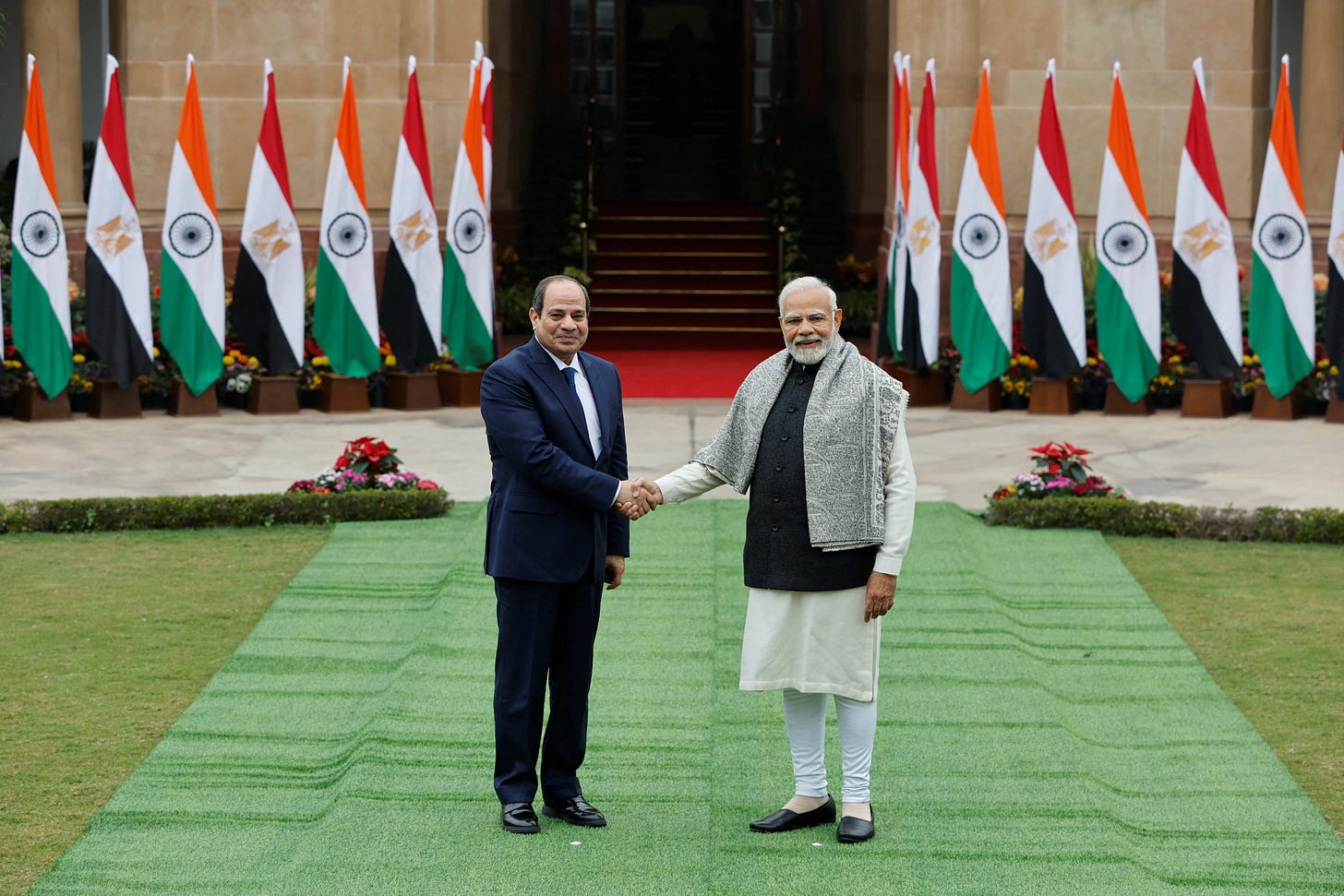

3️⃣India Throws A Lifeline to Egypt …

India is providing Egypt with a credit line of unspecified value, Egyptian Supply Minister Ali El-Mosilhy said, in the latest support from an ally for the North African nation's troubled economy. The Middle East's most populous nation is racing to turn around an economy that was heavily exposed to the shock waves of Russia's invasion of Ukraine and is a major importer of wheat and other commodities.

Egypt has agreed on a $3 billion deal with the International Monetary Fund, while its Gulf Arab allies have pledged billions of dollars in investment. Such credit lines are typically used to import key commodities, including food.

The facility could ease pressures on the economy, just as signs of progress in Egypt's plan to sell state assets and a tourism rebound lead Citigroup Inc. to predict authorities will hold off a devaluation of the currency until at least September.

Markets and business

1️⃣Grubhub Hops on the Tech Layoff Wagon🚙…

Things are absolutely tough in the Tech industry at the moment with more layoff underway. Grubhub will lay off roughly 15% of its workforce as the food-delivery service seeks to cut rising costs, the company said on Monday.

"While our business has grown since our 2019 pre-pandemic levels, our operating and staff costs have increased at a higher rate," Chief Executive Officer Howard Migdal said in a memo to employees. "These changes, while difficult, will help ensure we have the right resources and structure to focus on the business priorities and opportunities ahead."

The news was first reported by the Wall Street Journal. The reduction in jobs, which affects about 400 people, reflects the growing turmoil at the Chicago-based company.

2️⃣S&P 500 Doing Mad Numbers! Closes at Its Highest in Over a Year, Thanks to Carvana💰📈…

Carvana shares added to last week's surge after the company said it expects improved profit metrics. U.S. stocks climbed Monday, driving the S&P 500 to its highest level in more than a year, as investors looked ahead to a busy stretch packed with key economic reports and the Federal Reserve's latest interest-rate decision.

Coming off its fourth straight week of gains, the S&P 500 rose 0.9% to 4338.93, its highest close since April 2022. The Dow Jones Industrial Average ticked up 0.6%, or about 190 points, while the tech-heavy Nasdaq Composite advanced 1.5%.

After getting pummeled last year by a rapid rise in interest rates, stocks have recovered this year thanks in part to a stronger-than-expected economy and hopes that rates might not have much further to climb. Shares of a few big technology companies have led the way, buoyed by booming interest in businesses involved with artificial intelligence.

But the rally has broadened in recent days, with investors flocking to previously beaten-down stocks such as the online used-car retailer Carvana.

3️⃣GameStop shares plummet after firing CEO 🎮🛑…

GameStop fired CEO Matt Furlong two years after hiring him and appointed billionaire Ryan Cohen as executive chairman, sending the company's shares down 20% in extended trading.

A former executive at Amazon, Furlong joined GameStop in 2021, just months after the company was at the center of a "meme-stock" trading frenzy where a bunch of social media-armed traders talked up the value of the stock.

The videogame retailer also said it would not be holding an earnings call. Billionaire investor Cohen, who co-founded online pet products retailer Chewy, has been serving as chairman of GameStop since 2021 and is also a majority shareholder of the Texas-based company.

Wend’s Weekly Money/Investing Tip🤝

Inverted yield curve is amongst us, proceed with caution

It’s weird times in the market. Inflation is still high on annual basis (4% that is), the stock market is booming and seems no sign of easing, and banks are experiencing a credit crunch (in other words struggling to have borrowed money so they can lend to others).

More from us👇

If you really enjoy our content, please stay in touch with our community on Youtube, Instagram, and TikTok.

If you have any suggestions to further improve our content, and if there are certain topics you want covered, shoot us an email:

Reach us at contact@thewendapp.com

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by Giovanni, ex banking and capital markets consultant whom is a CFA (Chartered Financial Analyst) L1 and active investor.